A decade after India became the first country to mandate Corporate Social Responsibility (CSR) spending, a new report by Sattva Consulting reveals how the sector has matured into a multi-dimensional, purpose-driven movement that is reshaping corporate India’s approach to social impact. The study, titled “CSR’s Next Act: How the Coming Decade Will Redefine Corporate Impact”, maps major trends shaping the next phase of CSR, from intent-led investments and place based philanthropy to the rise of non-NGO implementation partners.

Also Read: Policy Research Missing in India’s CSR Spend, Experts Call for Course Correction

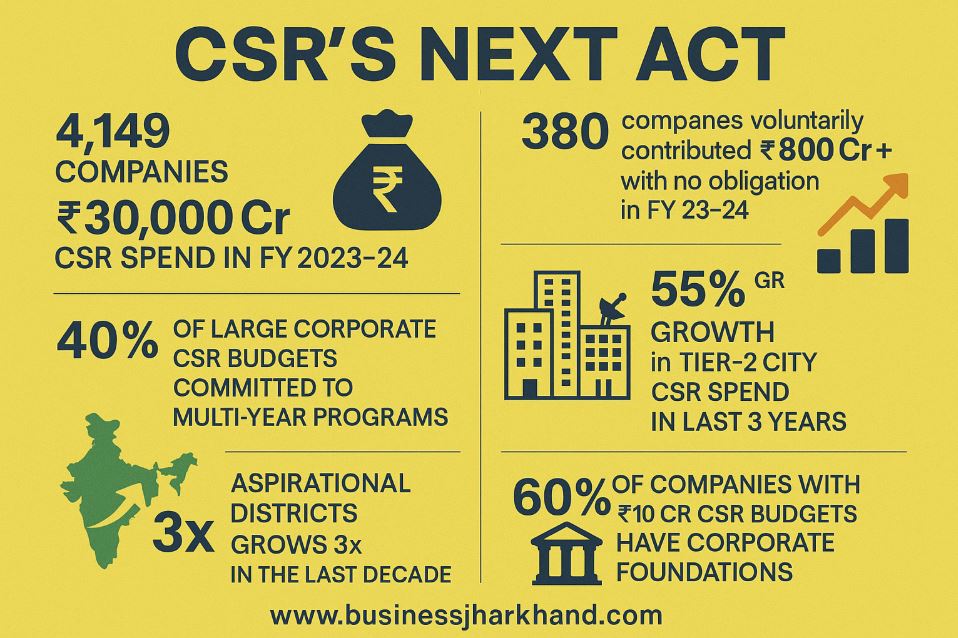

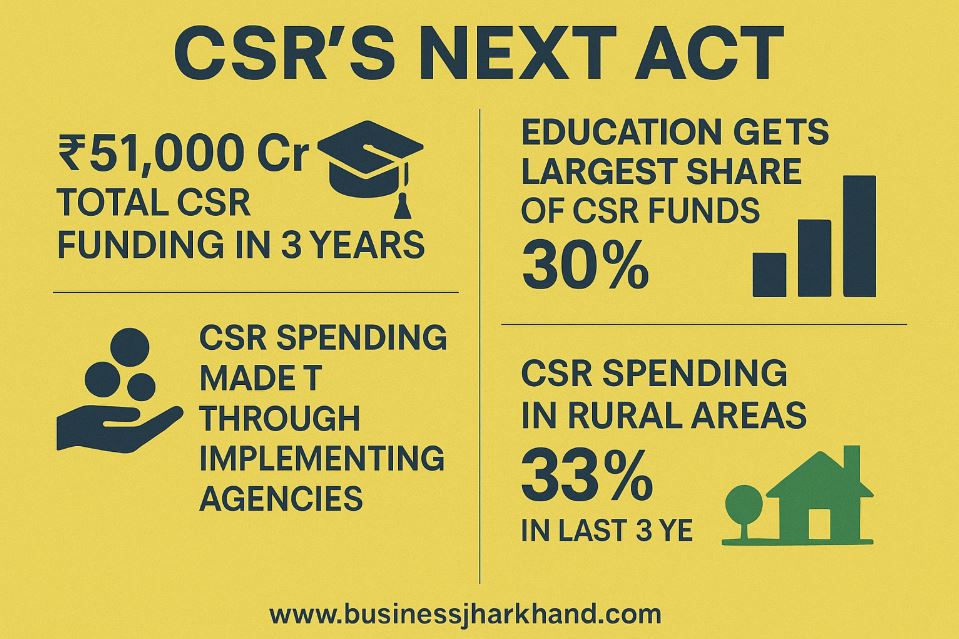

According to the report, 4149 companies accounted for Rs. 30000 crores in CSR spending during FY 2023–24, representing 87% of total corporate giving. Among them, 765 companies spent at least twice their mandated CSR budget, while another 380 companies without any legal obligation voluntarily contributed over Rs. 800 crores.

“This marks a significant shift from compliance to intent-driven investment,” said Srikrishna Sridhar Murthy, Co-founder and CEO of Sattva Consulting. “CSR is no longer just a legal requirement, it’s becoming a reflection of a company’s core values and business philosophy.”

Also Read: MCA Notified New CSR Rules, Mandated Fresh CSR-1 Registration from 14th July

CSR 2.0: From Metro-Centric to Distributed Giving

While Tier-1 cities like Mumbai, Delhi, and Bengaluru continue to attract substantial CSR inflows, the share of metros has declined from 33% to 29%, with Tier-2 cities and industrial hubs recording growth rates of 55% and 120%, respectively.

Industrial districts such as Jharsuguda, Raigarh, Jamnagar, and Ballari now absorb nearly one-fifth of total district level spending. However, the report warns that three-fourths of CSR funds still flow to just 193 districts, most of which have low poverty levels.

CSR investment in Aspirational Districts has grown threefold in the last decade from 1.3% to 4.5% of total inflows led primarily by public sector undertakings (PSUs) and large corporations in BFSI and energy sectors.

Also Read: Jharkhand Lost Two-Thirds of Its Elephant Population in Eight Years, DNA Based Census Revealed

A major finding of the report is that over half (51.5%) of CSR spending in FY 23–24 was directed toward sectors aligned with companies’ business needs, such as education, skilling, healthcare, and climate action. Industries like IT/ITES and Automotive showed the strongest alignment, with more than 75% of their CSR investments targeting education and skill development, key areas for building future talent pipelines. CSR is increasingly seen as “patient capital” for systemic change rather than short-term charity. Nearly 40% of large corporate CSR budgets are now tied to multi-year programs, underlining a strategic shift towards sustainable impact.

Also Read: Environment Ministry Classified 86 Industries as ‘White’ Category Minimal Polluters

Corporate Foundations and Non-NGO Partners on the Rise

The implementation landscape has undergone a dramatic transformation. While NGOs continue to play a vital role, specialised institutions such as universities, hospitals, incubators, and religious trusts now account for nearly 20% of CSR implementation funding. More than 60% of companies with CSR budgets above Rs. 10 crores now operate their own corporate foundations, enabling them to manage flagship, high-value programs with greater control and governance. Corporate Foundations collectively handled Rs. 4758 crores across 3689 projects between FY 2021–24, with average project sizes nearly double those managed by NGOs.

Also Read: Jharkhand’s Finance Minister Demanded State Control Over CSR Funds

Small Companies, Big Intent

Smaller firms, those spending under Rs. 1 crores annually are emerging as unsung champions of local impact. Despite limited budgets, these companies frequently exceed their mandated spending, supporting village schools, local health centers, and livelihood programs in their operational areas. In contrast, large corporates face challenges in deploying vast CSR funds effectively due to capacity constraints within partner organisations. Many have shifted to multi year projects and complex programmatic models that stretch beyond annual cycles.

Also Read: 300 Rural Youth to Get Free Job-Oriented Training under Tata Power Initiative

The report concludes that India’s CSR landscape has entered a transformative phase, plural, data-driven, and deeply intertwined with business purpose. The next frontier, it argues, lies in strengthening institutional capacity, improving alignment with development indicators, and ensuring that CSR resources reach India’s most underserved communities. The report notes that the future of CSR in India will not be defined merely by how much is spent, but by how deeply it connects business innovation with societal transformation.

Also Read: Tata Trust Reappointed TVS Group’s Honorary Chairman Venu Srinivasan as a Lifetime Trustee

Join the WhatsApp Group of Business Jharkhand to Stay tuned for all the latest updates of industrial-political developments in Jharkhand.