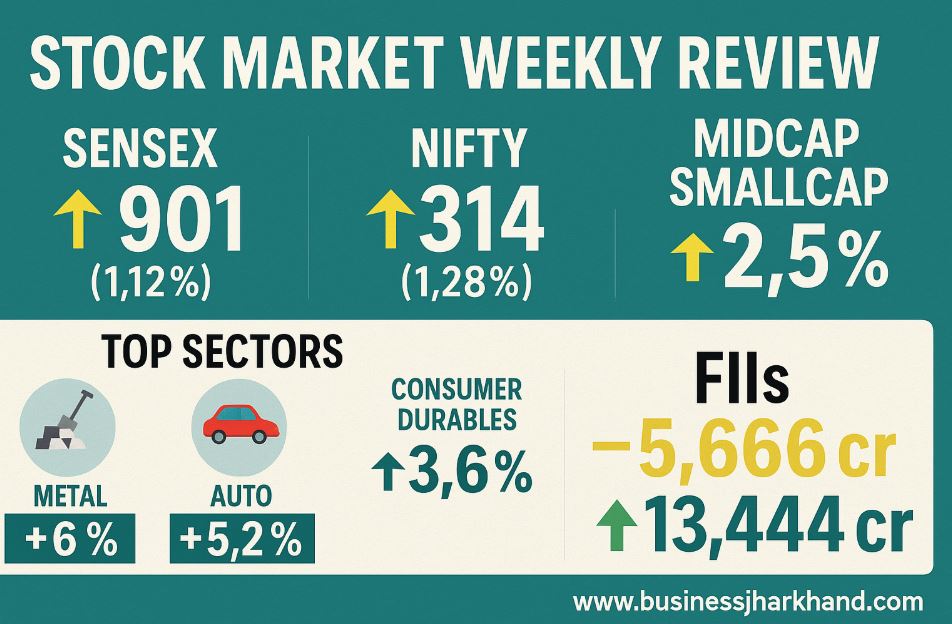

Indian equity markets ended the week with solid gains, supported by domestic institutional buying, GST system reforms and signs of improvement in the economy. The Sensex (currently at 80710.76) gained 901.11 points (1.12%), while the Nifty gained 314.15 points (1.28%), to close at 24,741 on 5th September, marking a strong close to the trading week.

Also Read: Coal India Set to Launch Roadshows for BCCL, CMPDI IPO

Midcap and Smallcap Indices Outperformed

The rally was broad-based, with mid- and small-cap stocks continuing to attract investor interest. The BSE Midcap index climbed 2%, while the Smallcap index surged 2.5% during the week. Among key performers, shares of SAIL, Aditya Birla Fashion & Retail, Rail Vikas Nigam, and NMDC featured in the midcap gainers’ list, while One Mobikwik Systems, Atul Auto, Netweb Technologies and Zydus Wellness recorded weekly gains ranging from 20% to 39% in the smallcap basket.

Also Read: Tata Steel Released Rs. 303 Crores Bonus to Over 25000 Employees

Metals and Autos Led Sectoral Rally

Sectorally, the BSE Metal index advanced 6%, backed by strong gains in Tata Steel and Jindal Steel. The Auto index rose 5.2%, led by Mahindra & Mahindra and TVS Motor, while Consumer Durables added 3.6% over the week. On the downside, the IT index slipped 1%, reflecting subdued demand in the technology segment.

FIIs Extended Selling, DIIs Supported Market

Foreign institutional investors continued their selling spree for the 10th consecutive week, offloading equities worth Rs. 5,666.90 crore. In contrast, domestic institutional investors extended their buying streak to the 21st week, purchasing shares worth Rs. 13,444.09 crore. Analysts noted that sustained domestic flows cushioned the impact of persistent FII selling and underpinned market strength across broader segments.

Also Read: PESB Announced Shortlist for Coal India CMD, final interview on 20th September

Join the WhatsApp Group of Business Jharkhand to Stay tuned for all the latest updates of industrial-political developments in Jharkhand.