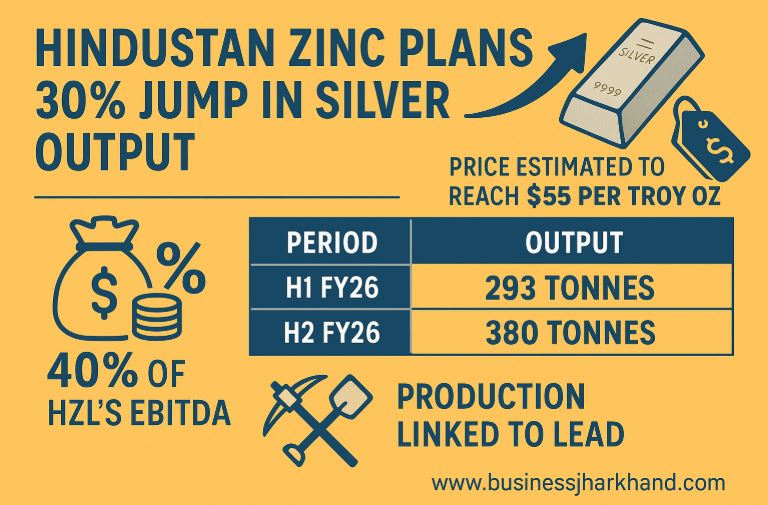

Hindustan Zinc Ltd (HZL), the country’s largest silver producer, planned to increase its silver output by nearly 30% in the second half of the fiscal year, banking on a sustained rally in global prices. The company targeted an output of around 380 tonnes between October and March, up from 293 tonnes in the first half of FY26. CEO Arun Misra projected that silver prices could climb as high as $55 per troy ounce by January, from about $51 currently.

Also Read: Ministry of Mines Announced Sixth Tranche of Critical Mineral Auctions

Lower Lead Output Pulled Down Silver Production in H1

Silver production at HZL dropped sharply in the first half of the year due to reduced lead output, which is closely tied to silver extraction. The company produced 144 tonnes of silver in the September quarter, down 22% year-on-year, following 149 tonnes in the June quarter, a 4% decline from the previous year. Misra described the second-half goal as a “stretched target”, but achievable given improved operational conditions and a focus on optimizing lead silver ores.

Also Read: Hindustan Copper and Jharkhand Government Signed 20-Year Lease for Rakha Copper Mine

Silver’s Share in Profit Reached All-Time High

Despite lower volumes, the silver segment contributed nearly 40% to HZL’s consolidated EBITDA in the September quarter, the highest ever share in its earnings mix. The company benefited from a sharp 34% year-on-year rise in average silver prices during the quarter, following a 17% rise in the June quarter. Prices of the precious metal recently touched all-time highs of over $54 per troy ounce before easing slightly to around $52. Misra expressed confidence that both higher prices and stronger second-half output would drive further earnings growth.

Also Read: Twenty First Century Mining to Begin Production in Jharkhand’s Tokisud Block-II by 2026

Balancing Lead and Zinc Production Strategy

Looking ahead, HZL plans to finalise its production roadmap for FY27 by early next year. Misra indicated that the company would prioritise zinc output, given stronger global prices of $2,900 to $3,000 per tonne, while optimising lead production from ore bodies richer in silver content. “With lead at $1,600–$1,800, it doesn’t make sense to produce more lead and less zinc,” he said, noting that the company would continue to align production with market dynamics.

Also Read: Heavy Rain Disrupted Lac Production in Jharkhand

Silver’s Strategic Role in HZL’s Portfolio

Silver has become a critical profit driver for Hindustan Zinc, supported by strong demand from industrial applications and investment markets. With global prices expected to remain firm, HZL’s decision to raise output aligns with its strategy of capturing value from precious metals while maintaining its dominance in zinc production. The company’s calibrated approach to balancing output across metals reflects a broader trend in India’s resource sector, focusing on profitability through efficiency and market timing.

Join the WhatsApp Group of Business Jharkhand to Stay tuned for all the latest updates of industrial-political developments in Jharkhand.